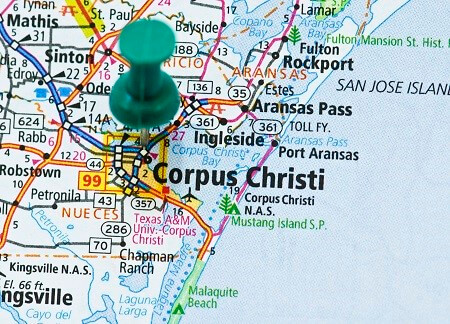

Title Loans Corpus Christi, Texas

You need cash? A title loan in Corpus Christi is the perfect solution for you. When you apply online now, you get personalized, instant service. You get detailed car title loan quotes from a wide range of reliable lenders. You get to keep your car while you use the cash. And best of all, this service is provided to you for free.

Use our convenient online locator to find the title loans in Texas that fit your personal needs. Low interest? High dollar loan cash? Flexible payment terms? You can only view options that match your criteria, saving you time and decreasing the hassle. You can also bounce ideas off our professionally trained team of experts. We’re here to assist you 24/7.

No Hassle Car Title Loans in Corpus Christi Available Now

If your financial situation is rocky, you probably would rather not take any more time off work than is necessary. Or maybe you’ve just lost your job and need cash sooner rather than later. You’re facing all sorts of difficulties on every front. The last thing you need is a troublesome loan application to drag you down even further.

Good thing you’ve come to us. Here’s what you can expect throughout the process of getting title loans in Corpus Christi:

- Professional, personable service all day and all night

- Friendly, informative explanations on loan terms you don’t understand

- Ability to hand pick your car title loan out of a variety of options

- Assurance that you’ll keep your car throughout the life of the loan

- Chance to match your loan repayment to your budget in a flexible way

There aren’t many other loans out there that can compete with this list.

No Credit Checks Simplify the Corpus Christi Car Title Loan Application

Think about what’s been holding you back for applying for cash or credit up until now. Chances are, one of the main obstacles in your way was your credit score. Aren’t you sick of having your past haunt you everywhere you turn? Corpus Christi car title loans aren’t based off your credit profile. Most lenders don’t even look at your score. They look at what physical proof you have that you can pay off a loan. If you hold a title in your hands without any liens, you’ve met the one and only title loan requirement and you are good to go. Forget about your credit – you can now start to live again.

Get the Cash You Need Without the Wait

Most title loans are ready to be finalized within a day. While we can’t make promises for certain, we can tell you that the time between when you apply and when you get your cash is minimal. Compared to other loan options, it blows the competition out of the water. For people who are looking for instant solutions to common financial problems, title loans from Corpus Christi lenders are the ideal method of obtaining funds fast.

If you’re ready to apply, why wait any longer? You can fill out the short online application form in less than 5 minutes and get the ball rolling right away. After all, we’re here around the clock, so we can send you your quote in just a few minutes. Aren’t you curious as to how much your car title is worth?